Finance

Choice of Bank and Opening Bank Accounts

It is recommended to choose big 4 banks (WBC, CBA, ANZ, and NAB). It is important to have a dedicated relationship manager from the chosen bank. The bank accounts to open are business transaction / cheque account, business online saver account, and term deposit account.

The Board of the CRC should establish a delegation of authority that clearly defines the delegation the board has provided to CRC management for matters of contracts and approving payments made by the CRC.

This should include the use of and limits for credit cards issued for the CRC’s bank account.

Segregation of Duties and payment controls

The CRC should ensure that segregation of duties and dual authorisation of payments are system-enforced controls within any payment platform the CRC utilises.

Accounting Software

As most CRCs are small to medium organisations, it is recommended to use Xero as the accounting software.

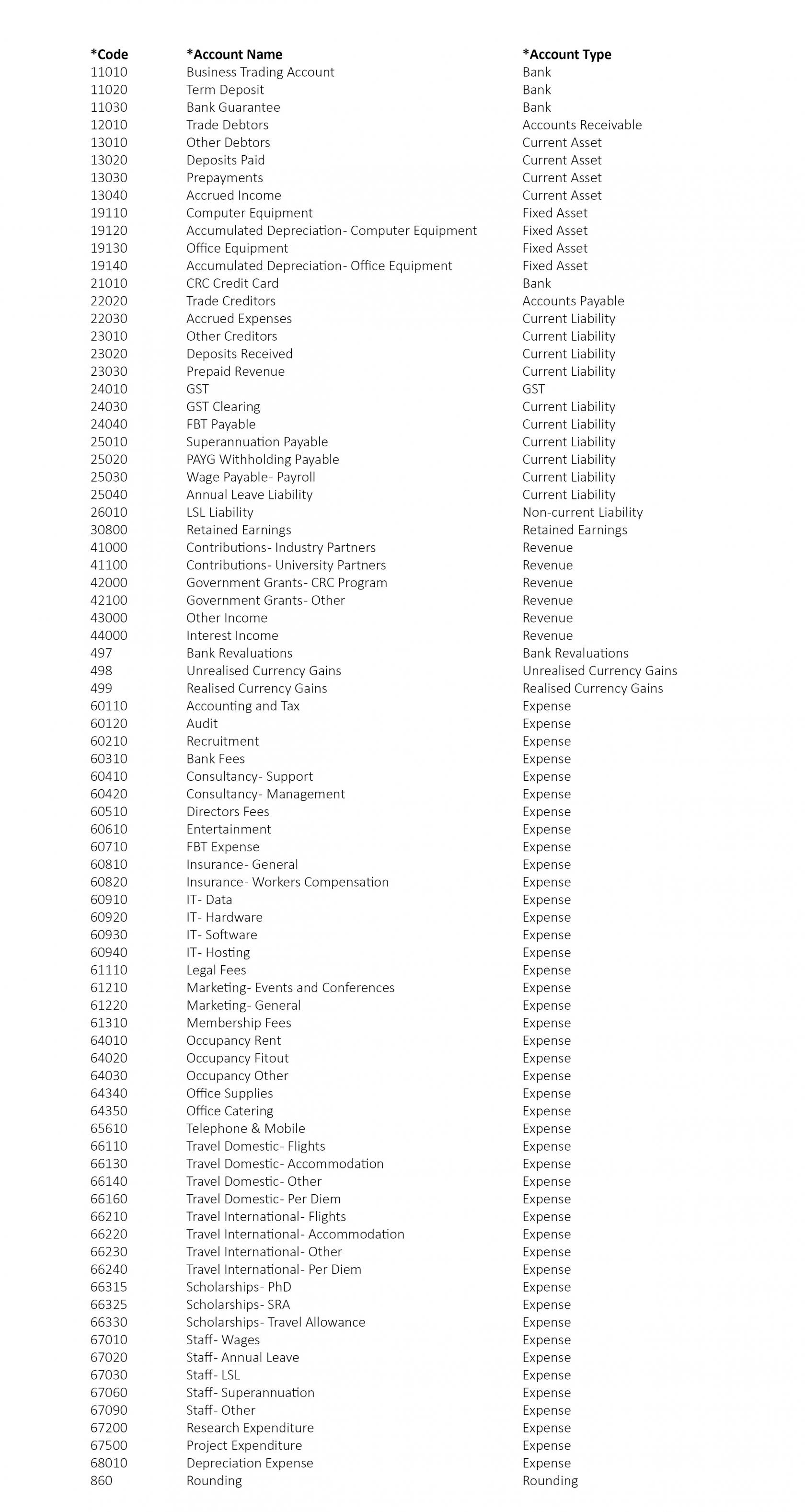

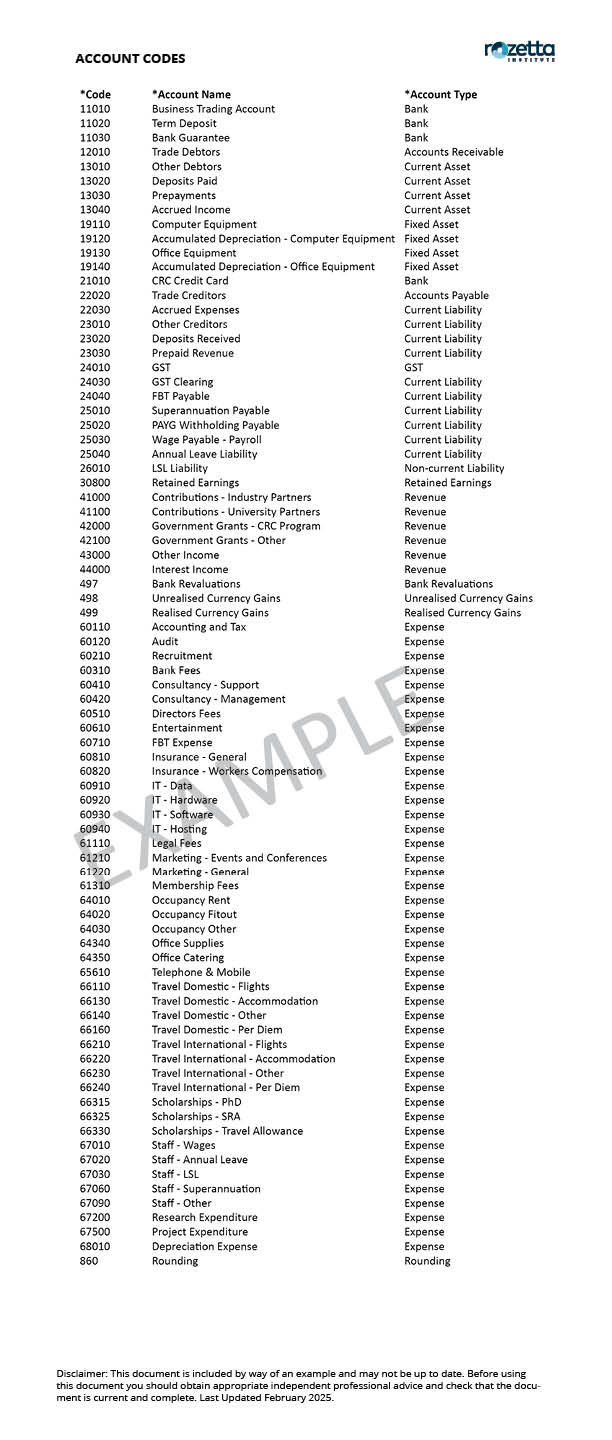

Chart of Accounts

An example of CRC ChartAccount of AccountsCodes can be found below:

Financial models are essential tools to ensure that the organisation’s financial health is maintained while delivering on its mission. These models help track cash contribution revenue sources, manage research expenses and staff cost, assess sustainability, and measure impact. Below are key financial models and approaches that CRCs typically use:

Profit & Loss Statement (Income Statement)

This is the primary financial statement used to monitor income and expenses over a specified period, such as monthly, quarterly, or annually. For a CRC organisation, the purpose is to ensure financial sustainability while fulfilling the organisational mission.

Key components:

Revenue: This includes Commonwealth grant, cash contribution from both university and industry partners, and other sources of income.

Expenses: These are the costs related to delivering programs, administration costs, staff salaries, PhD scholarship, and other operational costs.

Surplus or Deficit: The result of income minus expenses. A surplus can be reinvested into future programs or saved for future operational costs.

Balance Sheet (Statement of Financial Position)

This provides a snapshot of the CRC’s financial position at a particular point in time, listing assets, liabilities, and net assets (equity). For CRCs, equity is often referred to as "net assets."

Key components:

Assets: What the organisation owns, including cash, term deposits, Prepayments, and equipment (fixed assets).

Liabilities: What the organisation owes, including loans, unpaid bills, and other debts.

Net Assets (Equity): The difference between assets and liabilities. This is the portion of the organisation’s value that belongs to the CRC after all debts have been accounted for.

Cashflow Forecast

This document tracks the flow of cash into and out of the organisation. It helps to assess whether the CRC has enough liquidity to meet its operational needs and manage its research activities effectively.

Key components:

Cash Inflows: Cash received from grants, cash contributions from both university and industry partners, and interest income.

Cash Outflows: Payment of research activities, PhD scholarship costs, and operational expenses.

Aged Receivables Report

An Aged Receivables Report is a financial tool that categorises outstanding invoices or amounts owed to a CRC, based on how long the payment has been overdue. The report typically segments receivables into the following time brackets:

- Current (0-30 days): Receivables that are within the payment terms.

- 30-60 Days: Receivables that are 30 to 60 days overdue.

- 60-90 Days: Receivables that are 60 to 90 days overdue.

- 90+ Days: Receivables that are more than 90 days overdue and considered high-risk for non-payment.

This report can be generated by most accounting software and helps CRCs track overdue partners’ cash contribution, prioritise collections, and take necessary actions to recover funds.

CRC Budget Model

The budget helps CRC allocate resources to specific research projects and assess the financial efficiency of each program. A CRC budget model typically consists of several key components that ensure transparency, accountability, and financial health while aligning with the organisation’s mission and goals. Below are the essential components of income and expenses to develop a budget model for a CRC.

Income Sources: Government grants as per the CRC Commonwealth agreement and payment milestone, university and industry partners’ cash contribution as per agreed contribution schedule, and other revenue (including interest income).

Expenditure Categories: staff costs, research project expenditures, PhD scholarship costs, education & capacity building, commercialisation costs (at later CRC stage), insurance, travel, auditing, IP & technology, and other operational expenses.

By creating a clear and detailed budget, a CRC organisation can ensure a balanced approach to financial health, mission delivery, and transparency with members.

Financial Reporting

Recommended financial reporting cycle and process includes:

- Monthly financial reports (Profit and Loss Statement, Balance Sheet, and Aged Receivables) reviewed by the management team

- Quarterly financial reports (Profit and Loss Statement, Balance Sheet, Cashflow Forecast, and Aged Receivables) to be presented to the Audit Risk Finance Committee and the Board

- Annual budget and cashflow forecast to be endorsed by Audit Risk Finance Committee and approved by the Board